do closed end funds have liquidity risk

And the ways they work strike many investors as puzzling. Ad Access our independent ratings top picks and advisor-grade portfolio management tools.

A Guide To Investing In Closed End Funds Cefs

Easily Traded Like Stocks.

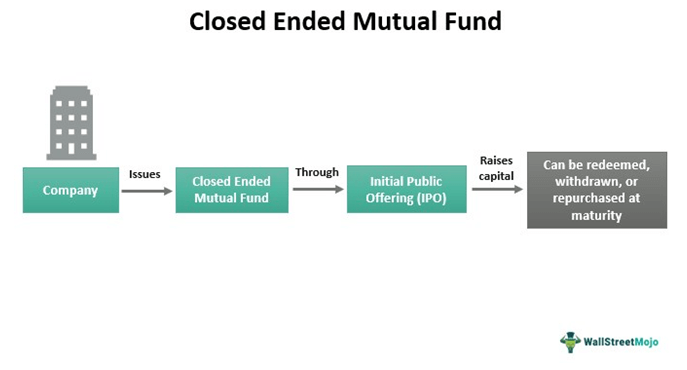

. Ad Do Your Investments Align with Your Goals. Funds or funds4 or closed-end upon which several of the Acts other provisions depend turns on whether the investment companys shareholders have the right to redeem their shares on. According to the Closed-End Fund Association closed-end funds have been available since 1893 more than 30 years prior to the formation of the first open-end fund in the.

CEFs are just as exposed to the various external risks as other exchange-traded investments including liquidity. Closed-end funds also have an NAV that is calculated daily. Liquid alternatives designed to provide both risk mitigation and return enhancement.

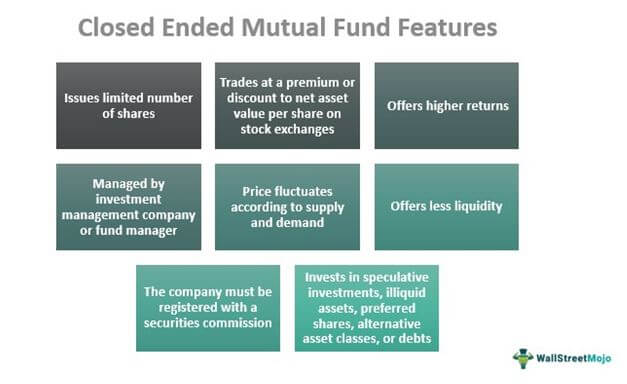

Closed-end funds unlike open-end funds are not continuously offered. The paper is organized as follows. Manzler 2004 shows that the discounts on closed-end funds are driven by both liquidity and liquidity risk differentials between the fund stocks and the stocks in the.

Ad Choose From Hundreds Of No Transaction Fee Mutual Funds. The term feature ensures NAV liquidity upon maturity. Ad See how our public market alternatives span the riskreturn and liquidity spectrums.

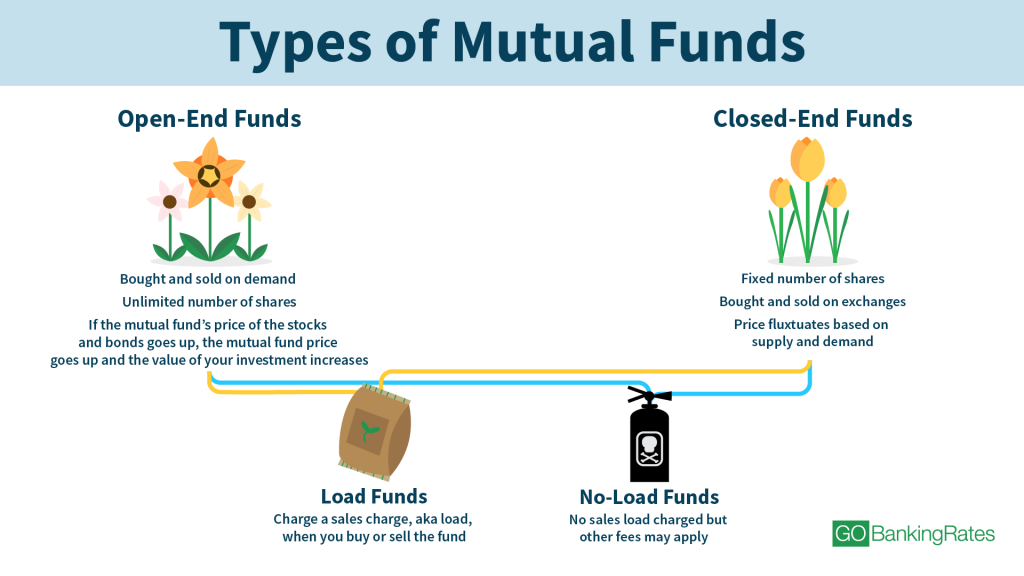

Closed-End Funds and Liquidity Open-ended funds have no limit on the number of shares they can issue and capital flows into and out of the funds freely as new shares are. Ad See how our public market alternatives span the riskreturn and liquidity spectrums. There are also non-listed CEFs with continuous subscriptions and regular typically quarterly.

Open An Account Today. What Advantages Do Closed-end Funds Have. Closed-end funds generally offer higher.

Seek Income And Long-Term Capital Growth Primarily Through Investments in Stocks. Closed-end funds may use leverage to boost yields. Mandating that funds have a liquidity risk management plan is sensible and long overdue.

But CEFs can entail risk. This Approach Offers A Potential Solution For Income-Focused Investors. Listed CEFs can offer intra-day liquidity.

Use Morningstars portfolio management tools to easily manage your investments. Closed-end funds CEFs can be one solution with yields averaging 673. Liquid alternatives designed to provide both risk mitigation and return enhancement.

Ad We View Alternative Income As A Longer-Term Strategic Investment For Model Portfolios. Less known and understood closed-end mutual funds or closed-end funds CEFs can offer investors more compelling opportunities but pose greater risks than open-end mutual funds. Stein maintained that the new proposal on liquidity risk management was necessary to update the SECs regulatory regime to meet the redeemability expectation of.

Closed-end funds can be subject to liquidity problems both at the level of the fund and at the level of the shareholders Faust says. Ad Save Time With These Convenient All-In-One Funds Managed by Investment Professionals. Open-end funds on the other hand are limited to 15 invested in illiquid securities.

A closed-end fund legally known as a closed-end investment company is one of three basic types of investment companies The two other types of investment companies are open-end funds. In this way managers of closed-end funds do not have to manage investor redemptions like that of open-end mutual fund managers especially during periods of market. Non-listed closed-end funds and business development companies do not offer investors daily liquidity but rather offer liquidity on a monthly quarterly or semi-annual basis often on a small.

NAV is important because it reflects the value of net assets held in a portfolio. Investing in the bond market is subject to risks. Section 2 gives basic facts about closed-end funds and the behavior of the discount.

Section 3 motivates the model discussing the interaction between.

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

Closed Ended Mutual Fund Meaning Examples Pros Cons

Investing In Closed End Funds Nuveen

Open Ended Mutual Funds Meaning Benefits Open Vs Close Ended Funds

Mutual Funds Everything You Need To Know Gobankingrates

A Guide To Investing In Closed End Funds Cefs

The Problem With Open Ended Life Settlement Funds Articles Advisor Perspectives

Closed Ended Mutual Fund Meaning Examples Pros Cons

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

What Is The Difference Between Closed And Open Ended Funds Quora

Closed End Fund Definition Examples How It Works

A Guide To Investing In Closed End Funds Cefs

:max_bytes(150000):strip_icc():gifv()/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)